With every financial plan now needing an estate plan, finding the right estate planning software...

Compare Wealth.com vs. EncorEstate vs. Vanilla Estate Planning Software for Advisors

Key Takeaways

-

The top three estate planning solutions for advisors that should be at the top of your list are Wealth.com, EncorEstate Plans, and Vanilla. Encore ranks #1 for both small and enterprise RIAs according to Kitces.com.

-

The three main differences among Wealth, Vanilla, and EncorEstate are: 1) The way you prefer facilitating estate plans: advisor-driven or client-driven, i.e., do you want to be in the driver's seat of the estate planning process from start to finish with your clients? Or do you prefer riding shotgun and just sending clients a link to get their estate plan done? 2) If industry-leading, white glove support experience at no cost is a big factor in your decisionmaking, and 3) How much flexibility and customization you'd like in the estate documents you're facilitating for your clients (especially crucial when your clients have beneficiaries and want custom distributions).

-

This guide is an attempt to help clarify what is available within each platform and highlight the nuances among them based on advisor satisfaction ratings, advisor-driven vs. client-driven estate planning experience, total cost of ownership, estate plan modeling and analysis, document creation, estate plan execution, and trust funding.

-

These data points are provided to the best of our knowledge and attempt to be fair in our assessment. There will be gaps and analysis that could be up for debate. This information should be validated with each company confirming the services they provide. We welcome feedback if there is information here that is not reflective of another firm's offering. Features continue to change as we all continue to develop our offerings.

-

-

Wealth.com, Vanilla, and EncorEstate Plans all do great work with advisors (we have friends who work at both Wealth and Vanilla). Like everything in life, it depends which is considered the "best" based on your priorities. For example:

-

If industry-leading advisor satisfaction, white glove support, and estate document creation + trust funding in one platform are your biggest needs, then you'll find that in EncorEstate.

-

If you prefer a beautiful interface and sending links to your clients to get their estate plans done, then consider Wealth.com.

-

If robust estate modeling and analysis (especially for UNHW clients) are your top priorities, then look at Vanilla.

-

Key Differences Between Wealth, Vanilla, and EncorEstate Plans

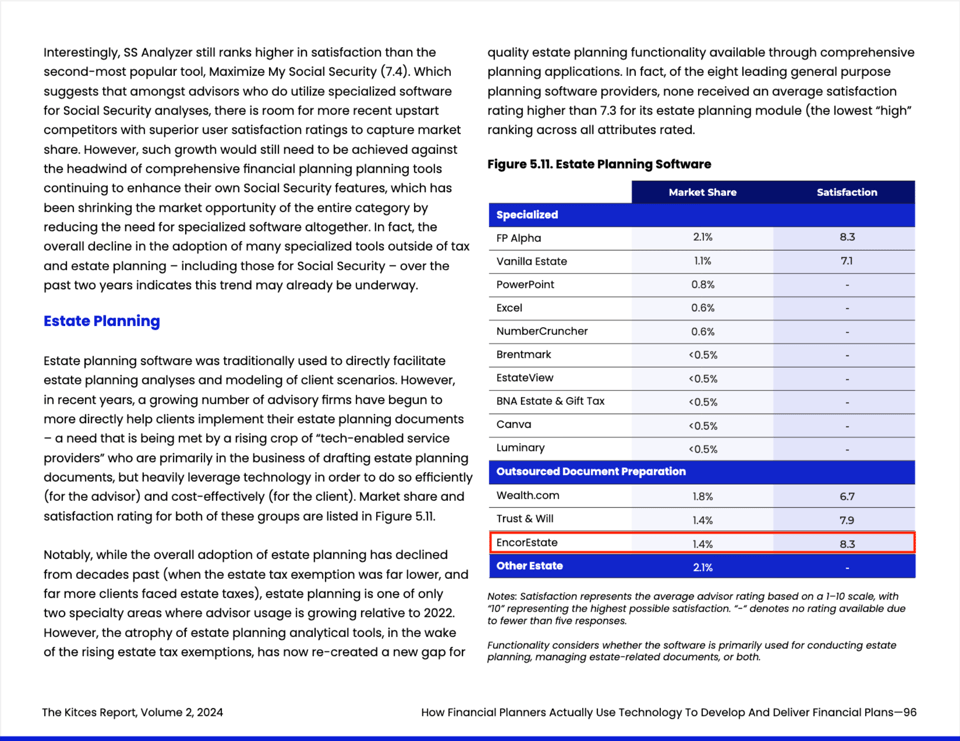

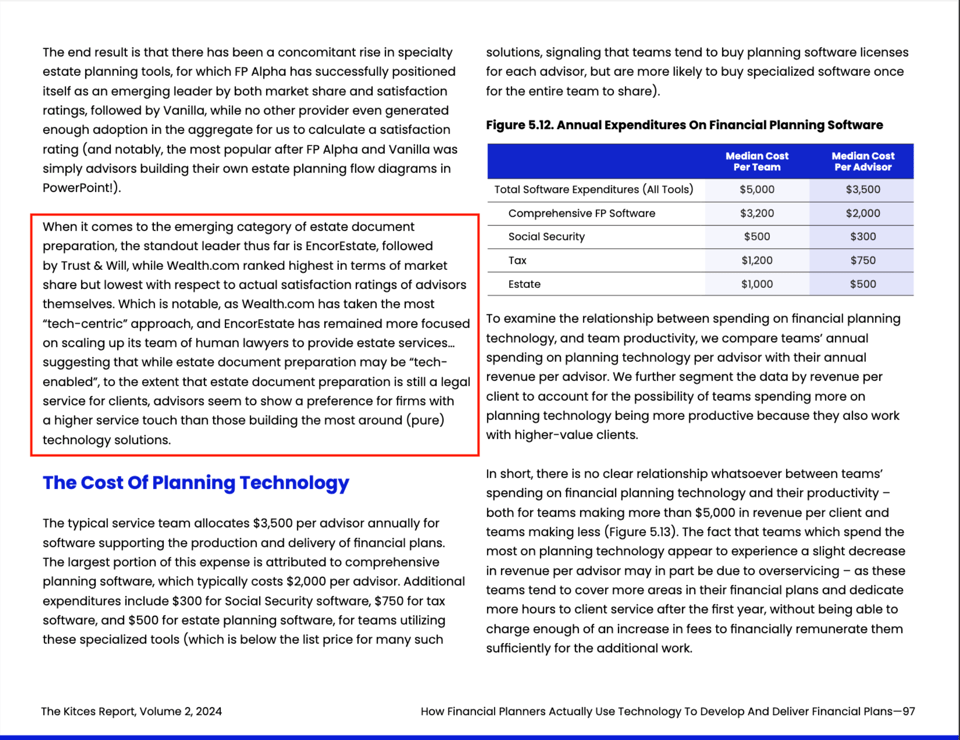

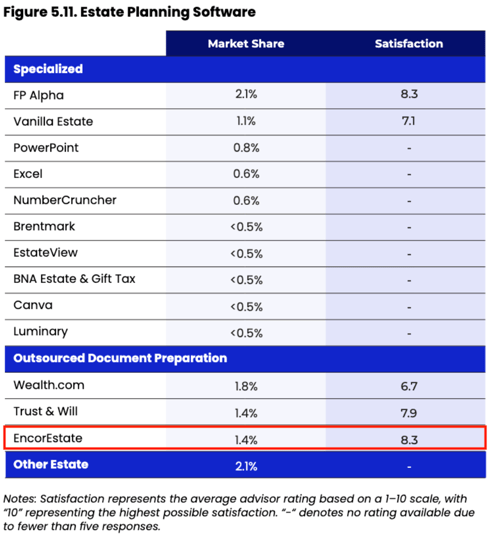

Advisor Satisfaction Ratings (Sources: Kitces.com and T3/Inside Information)

Before we dive into details, let's start with what actually matters: how advisors actually feel about Wealth.com, Vanilla, and EncorEstate Plans.

| Estate Planning Software for Advisors | |||

| Survey | Wealth.com | Vanilla | EncorEstate Plans |

| 2024 Kitces Advisor Productivity Survey* (published April 2025) | 6.7/10 | 7.1/10 | 8.3/10 |

| 2025 T3/Inside Information Advisor Technology Survey (published March 2025) | 8.24/10 | 7.23/10 | 8.47/10 |

| 2025 Kitces AdvisorTech Survey (published August 2025) | 7.3/10 | 7.4/10 | 8.0/10 |

*Rating was specific to document creation ("estate document prep"), not estate summary nor modeling/analysis capabilities.

- 2025 Kitces AdvisorTech Survey

- 2025 T3/Inside Information Advisor Software Survey

- 2024 Kitces Financial Planner Productivity Study, "How Financial Planners Actually Do Financial Planning"

Client Estate Planning Experience: Advisor-driven vs Client-driven

Despite the dozens of DIY estate planning software options that are on the market and the tried-and-tested option of having an estate attorney create and fund an estate plan, 67% of Americans still don't have an estate plan.

Among the top three estate planning solutions for advisors in 2025, there are big differences in how involved the advisor will be in the software input process for clients:

- Wealth and Vanilla: there's little to no involvement other than advisors sending a link to clients.

- EncorEstate Plans: provides the option to the advisor to facilitate the software for clients, leveraging and pointing clients to the educational resources they need when they have questions.

- Of course, it all depends on what experience advisors prefer to deliver to their clients: some prefer to delegate to clients, while others prefer to be in the driver's seat.

- According to EncorEstate Plans's research, clients have an 87% chance of completing the estate planning process when the advisor facilitates the software for them vs. client-driven software experiences, which haven't solved for client procrastination and consistently result in very low estate plan completion rates.

| Estate Planning Software for Advisors | |||

| Client Estate Planning Experience | Wealth.com | Vanilla | EncorEstate Plans |

| Advisor-driven | ❌ No | ❌ No | ✅ Yes |

| Client-driven | ✅ Yes | ✅ Yes | ✅ Yes |

- EncorEstate Plans internal data from over 14,000 completed and funded estate plans.

- Wealth's website.

- Vanilla's website.

Total Cost of Ownership In Terms of Price and Your Clients' Data

Depending on your cost commitment preference (e.g., annual subscription vs. pay-as-you-go) and whether you're okay with a vendor locking in your clients' data and estate plan updates unless you pay a subscription, this table will help you get a clearer picture of the actual cost of ownership of one of the top three estate planning platforms for advisors.

| Estate Planning Software for Advisors | |||

| Pricing and Data Retention | Wealth.com | Vanilla | EncorEstate Plans |

| Requires annual subscription contract | ❌ Yes | ❌ Yes* | ✅ No |

| Pay-per-plan | ❌ No | ✅ Yes | ✅ Yes |

| Access to client data and estate plan updates without a subscription | ❌ No | ❌ No | ✅ Yes |

| "Unlimited" estate plans and amendments per advisor license** (subject to fair use policy, but with a cap at 120 total clients per advisor license***) | ✅ Yes | ❌ No | ❌ No |

*Vanilla has required annual subscriptions for access and requires additional payment per estate plan.

**You can only amend plans if the advisor is still actively subscribed to Wealth.com.

***According to several advisors who evaluated both Wealth.com and Vanilla.

Estate Plan Modeling and Analysis

Advisors of UHNW clients can deliver great value in modeling and providing analysis of existing estate plan documents, especially for those with clients impacted by today's federal or state estate tax laws today.

The estate modeling and analysis features in the top vendors, though, are focused on forecasting projections under existing estate tax laws. And, they operate on the assumption that today’s estate tax laws will be the same in the future, even though these laws historically have been subjected to dramatic changes.

What's certain is that providing easy-to-understand estate plan summaries are valuable for all clients, especially the mass affluent. Such summaries allow clients to revisit and easily understand their estate plan decisions and share those with appropriate relationships (e.g., financial planners, estate attorneys, guardians to their minor children).

| Estate Planning Software for Advisors | |||

| Modeling and Analysis Features | Wealth.com | Vanilla | EncorEstate Plans |

| Existing and new estate plan summaries | ✅ Yes | ✅ Yes | ✅ Yes |

| Turnkey completed summary | ❌ No | ✅ Yes | ✅ Yes |

| Estate modeling and analysis | ✅ Yes | ✅ Yes | ❌ No |

| Custodial integrations for analysis | ✅ Yes | ✅ Yes | ❌ No |

| Instant AI-generated summary (advisor proofreading required) | ✅ Yes (Ester AI)* | ❌ No | ❌ No |

| Uncover trusts that need funding where property deeds were never titled into the trust (probate avoidance) | ❌ No | ❌ No | ✅ Yes |

| Knowledge base | ✅ Yes | ✅ Yes | ✅ Yes |

*Note: If an existing trust has amendments, Ester cannot account for them. Wealth will make advisors manually read the amendments and enter the details into the Wealth platform manually.

Document Creation

Wealth, Vanilla, and EncorEstate operate as a scrivener (i.e., a scribe) service, which are a well-established category of software that allows consumers to create their own documents without being offered legal advice or a specific opinion of the documents' contents.

Compared to higher touch estate planning platforms like EncorEstate Plans, tech-only solutions are limited in fulfilling clients' estate planning wishes and desires (in fact, custom estate plan requests are very common). At EncorEstate for example, having our team of estate planners, paralegals, and estate attorneys review each estate document enables clients to incorporate specific requests.

According to Encore's research, 32% of estate plans have customized requests from clients that EncorEstate's human review process is able to incorporate into the documents for clients. Note: these requests are ones that cannot be accomplished by software alone. In tech-only platforms, these plans are often prevented from being completed with the clients' full desires or the platforms require the client to go beyond their advisor and seek a referral attorney. Most often, these clients are ones who have previously procrastinated on getting their estate plans done via an estate attorney referral.

This section presents a comparison of common requests clients have and each platform's ability to handle them. There are many more subtle, nuanced requests clients commonly have that fall into only being accomplished by a human reviewer (e.g., Encore estate planner or paralegal) or attorney referral.

| Estate Planning Software for Advisors | |||

| Flexibility & Degree of Customization for Clients | Wealth.com | Vanilla | EncorEstate Plans |

| New trust or will | ✅ Yes | ✅ Yes | ✅ Yes |

| Restate existing trusts set up outside of the platform | ❌ No | ❌ No | ✅ Yes |

| Amend estate plans | ✅ Yes | ✅ Yes | ✅ Yes |

| Human quality control included on every plan | ❌ No | ❌ No | ✅ Yes |

| Immediate access to documents | ✅ Yes | ✅ Yes | ❌ No |

| Third-party attorney access for trust funding (additional fee) | ✅ Yes | ✅ Yes | ✅ Yes |

| Software-integrated third-party attorney review with advisor and client (letter and or phone call) | ❌ No | ❌ No | ✅ Yes |

| Corporate trustee language | ❌ No | ❌ No | ✅ Yes |

| Special Needs Trust (SNT) language for beneficiaries | ❌ No | ❌ No | ✅ Yes |

| Unlimited support at no cost | ❌ No | ❌ No** | ✅ Yes |

| Document Vault available | ✅ Yes* | N/A | *✅ Yes |

*Wealth.com's Document Vault is available as long as you're a paying subscriber.

**According to several advisors, Vanilla's support only consists of email support and a weekly support office hours webinar on Tuesdays at 8am Pacific Time.

Estate Plan Execution

Estate documents are only as good as how they're signed in accordance with state laws for notarization and witness execution.

Wealth, Vanilla, and EncorEstate all offer the printing, binding, and shipment of estate plans to your clients. But, only Encore provides a one-click option in its platform to request a mobile notary and witnesses to be sent to your client's house for estate document signing.

| Estate Planning Software for Advisors | |||

| Estate Plan Execution Options | Wealth.com | Vanilla | EncorEstate Plans |

| Print, bind, and ship estate plans to your clients | ✅ Yes | ✅ Yes | ✅ Yes |

| Software-integrated mobile notary and witnesses service | ❌ No | ❌ No | ✅ Yes |

Trust Funding

You and your clients have won half the battle once the estate documents are validated and notarized. But, if your clients have a living trust, you'll need to make sure the trust is properly funded (e.g., retitling property deed into the trust).

Estate planning platforms for advisory firms vary on what they can do to help fund clients' trusts and how easy they make it for the client to properly fund their trust.

| Estate Planning Software for Advisors | |||

| Trust Funding Options | Wealth.com | Vanilla | EncorEstate Plans |

| Full-service deed prep and recording | ❌ No | ❌ No | ✅ Yes |

| Business interest assignments | ❌ No | ❌ No | ✅ Yes |

| Exhibit A / Schedule A | ✅ Yes | ✅ Yes | ✅ Yes |

Note: EncorEstate's Support Team of estate planners and paralegals will pull the last recorded deed, prepare the deed, and prepare all county-specific documents – even if you’re not an Encore customer. You nor your clients need to go to the assessor's office and or hunt down various forms because Encore will do it all for you and your clients.

FAQs

How valid are these feature comparisons?

We cross-referenced Wealth.com, Vanilla, and EncorEstate Plans's websites to make sure the latest information was presented here in this side-by-side comparison of the top three estate planning platforms for advisors.

Does Wealth.com actually have unlimited estate plans pricing?

No, Wealth.com does not actually have unlimited estate plans pricing. Their "unlimited" estate plans pricing is capped at 120 total clients per advisor license (subject to fair use policy) according to several advisors who evaluated Wealth.com.

Can Wealth.com's Ester AI read amendments in an existing trust?

If an existing trust has amendments, Ester cannot account for them. Wealth will make advisors manually read the amendments and enter the details into Wealth manually.

What's the best way to evaluate each estate planning platform for advisory firms?

As you read the "feature parade" as part of your evaluation of these tools for you and your firm, make sure to ask these questions during sales demos with Wealth.com, Vanilla, and EncorEstate Plans:

- How would this tool fit our workflow?

- Can a member of the support team actually help me with my questions before I'm a customer?

- Does it cost me extra to contact support? And is the support staff primarily product support or actual estate planning support?

- Does it actually help me close the estate planning procrastination gap for my clients?

- Can it scale with our operations?

- Will I be able to keep and access my clients' data even when I'm no longer a customer of the tool?

If your answers lean towards making the estate planning experience for your clients not suck, and you want white glove support and estate plan document flexibility and customization, well, you know where to find us 😄

Get a personalized deep-dive of the Encore platform. We're not trying to win a feature checklist – we want you to kick all the estate planning butt.

What's the best way to evaluate the EncorEstate Plans platform?

if you're evaluating estate planning software providers, have a conversation with EncorEstate.

What makes EncorEstate a top choice for high-touch estate support?

Three reasons why Encore is a top choice for advisors wanting high-touch estate support:

- Encore puts advisors in the driver's seat from start to finish of the estate planning process with their clients.

- Encore has the industry-leading customer support service that will help guide you and or answer your questions at no extra cost (as confirmed by it having the highest advisor satisfaction ratings according to Kitces and T3/Inside Information.

- Encore offers unmatched customization (e.g., Special Needs trusts, corporate trustee language, restatements), a 60-point human review of each estate plan, and estate document creation + trust funding in one platform.

Which estate planning software for advisors has better client satisfaction ratings?

EncorEstate Plans has the best client satisfaction ratings based on the latest Kitces.com Advisor Productivity Survey published in April 2025 (with a satisfaction rating of 8.3/10) and T3/Inside Information Advisor Technology Survey published in March 2025 (with a satisfaction rating of 8.47/10).

Where can I see EncorEstate, Wealth.com, Vanilla, and other estate planning providers' ratings according to Kitces?

You can see EncorEstate Plans and other estate planning tools for advisors' ratings in these table images below:

Tables from the Kitces Advisor Productivity Survey Showing Why EncorEstate is Tops