Key Takeaways Wealth.com does not allow clients to properly fund their trust (source: Wealth.com...

How to Fund Trusts with Wealth.com

Key Takeaways

-

Wealth.com does not allow clients to properly fund their trust (source: Wealth.com customer on Reddit). According to that Wealth.com customer, Wealth's "advice is to seek out an attorney to do this. But that would defeat the purpose of using the platform." Like Vanilla and Trust & Will, Wealth.com does not file client deeds with counties.

- To properly fund a trust-based estate plan with Wealth.com, you'll need to re-title assets like real estate through EncorEstate Plans's property deed filing service.

- In fact, many Wealth.com customers use EncorEstate Plans to fund their clients' living trusts.

-

Wealth.com has resources, though (e.g., webinars) that outline different ways to fund living trusts.

- EncorEstate Plans is the best alternative to Wealth.com if you want a truly comprehensive estate estate planning platform that creates high caliber estate documents and funds trust-based estate plans.

Step-by-Step Instructions for Funding Trusts with Wealth.com

Step 1: Have Your Clients Complete their Estate Documents

Your clients can easily fill in their beneficiaries and trustees' information through their Wealth.com client portal.

You and your clients will have won half the estate planning battle once the estate documents are validated and notarized (can be through an estate attorney or mobile notary service; note: you'll need a free Encore account to view the mobile notary page).

Step 2: Properly Fund Clients' Trusts through EncorEstate Plans's Property Deed Filing Service

If your clients have a living trust, you'll need to make sure the trust is properly funded (e.g., retitling property deed into the trust).

You could refer your clients to estate attorneys via Wealth.com's estate attorney partner network to complete trust funding. Doing so seems straightforward and easy for advisors and their clients.

But, referring clients to an attorney to get their estate plan funded reintroduces the same procrastination pitfalls that prevent estate plans from being executed, i.e., when are clients going to actually get their trusts are funded?

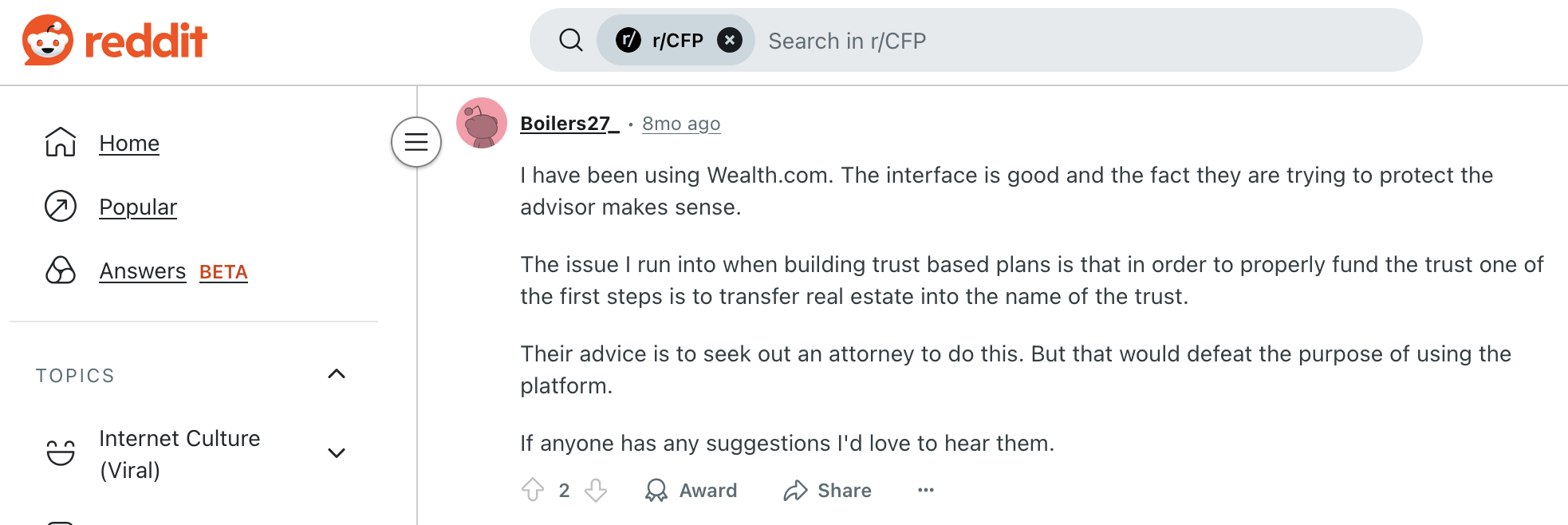

One Wealth.com customer on Reddit speaks to this exact pitfall about referring clients to an estate attorney to complete trust funding, citing that doing so "would defeat the purpose of using the [Wealth.com] platform":

"The issue I run into when building trust based plans is that in order to properly fund the trust one of the first steps is to transfer real estate into the name of the trust.

Their advice is to seek out an attorney to do this. But that would defeat the purpose of using the platform.

If anyone has any suggestions I'd love to hear them."

To properly fund your clients' trusts via re-titling real estate, you can leverage EncorEstate's deed filing service. You don't need to be an Encore customer to use the service.

And neither you nor your clients need to go to the assessor's office and or hunt down various forms – Encore will do all of that for you and your clients!

When you submit your deed filing request on behalf of your client, Encore's Support Team of estate planners and paralegals will:

- Pull the last recorded deed.

- Prepare the deed.

- Prepare all county-specific documents.

Compare Wealth.com vs. EncorEstate Plans's Trust Funding Capabilities

| Estate Planning Software for Advisors | ||

| Trust Funding Options | Wealth.com | EncorEstate Plans |

| Full-service deed prep and recording | ❌ No | ✅ Yes |

| Business interest assignments | ❌ No | ✅ Yes |

| Exhibit A / Schedule A | ✅ Yes | ✅ Yes |

Related: Compare Wealth.com vs. EncorEstate Plans vs. Vanilla

Meet EncorEstate Plans: The Best Alternative to Wealth.com

Wealth.com is a great estate planning platform with hundreds of financial advisory firms leveraging them to help clients ensure their estate plans are in place.

But, it has a big gap: it doesn't handle proper funding of clients' trusts. That's why many advisors using Wealth.com leverage Encore's property deed prep and recording service to close that trust funding gap.

Estate Document Creation Flexibility and Customization

In theory, many mass affluent clients have the same (if not similar) needs when it comes to estate planning. But, being able to customize estate documents to adapt them to your clients' needs is crucial, especially when it comes to beneficiaries. One-size-fits-all estate document templates clearly don't fit all!

Human Review of Every Estate Plan Document

Wealth.coms turn around client estate plan documents instantly. But, Encore's team of estate planners and paralegals takes five business days (using a 60-point review of every estate plan) to comb through each estate plan and ensure everything is correct and accurately reflects your clients' wishes.

EncorEstate will also answer any and all of your questions about estate planning and or your clients' plans over live chat, phone, and or email at no cost (we don't provide legal advice). Encore's unlimited human estate planner support to advisors is why we consistently score the highest advisor satisfaction ratings in industry surveys like Kitces.com AdvisorTech and Advisor Productivity Surveys, and T3/Inside Information Advisor Technology Survey.

And according to a Reddit user on the CFP sub-Reddit, Encore's "Support is unmatched":

Estate Plan Notarization

EncorEstate provides a one-click option in its software platform to request a mobile notary and witnesses to be sent to your client's house for estate document signing.

Trust Funding

EncorEstate's full-service deed prep and recording ensures your clients' trusts are properly funded with their real estate.

FAQs About EncorEstate Plans's Property Deed Prep and Recording Service

How valid are these feature comparisons?

We cross-referenced Wealth.com and EncorEstate Plans's websites to make sure the latest information was presented here.

I'm not an EncorEstate customer. Can I use the deed filing service?

Yes, you can. It doesn't matter if you use another estate planning software or have been working with an attorney: the Encore team just wants clients to have accurate AND properly funded estate plans 😄 In fact, it's been our mission since Day 1 to ensure that all Americans have up-to-date and funded estate plans in place.

Does Encore's deed filing service cover all of the US?

Encore's in-house deed filing service covers 95% of all US counties. For the remaining 5% of counties that Encore's Support Team is not able to cover, we'll provide guidance as best as we can to ensure advisors and their clients are at least pointed in the right direction.

How does Encore's deed filing service work?

Encore's Support Team of estate planners and paralegals will pull the last recorded deed, prepare the deed, and prepare all county-specific documents – even if you’re not an Encore customer.

What's the best way to evaluate the EncorEstate Plans platform?

if you're evaluating estate planning software providers, have a conversation with Encore.